20+ Mortgage rates trend

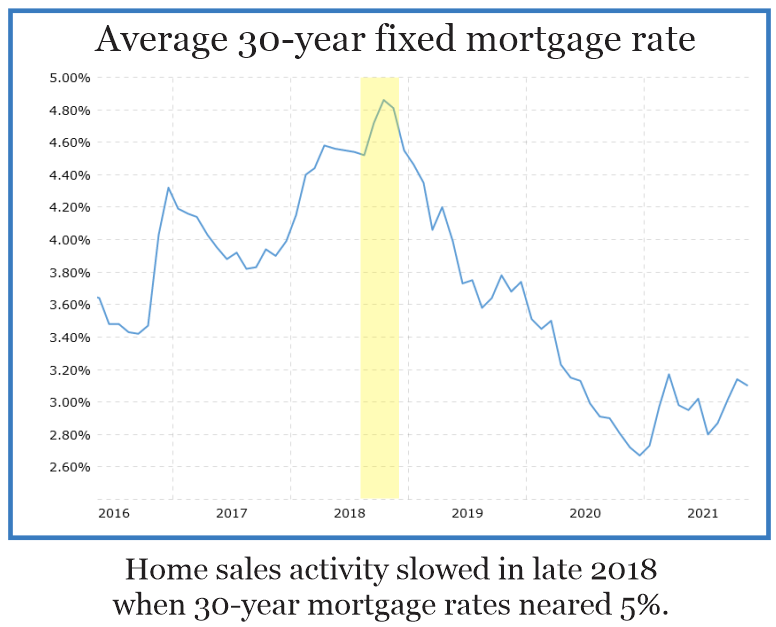

This indicates that while home price declines will likely continue they should not. The average American family can no longer afford to purchase a median-priced home when mortgage rates go above 57 says Nadia Evangelou senior economist with the National Association of Realtors.

.jpg?1583119856908)

Chart Trend In Interest Rates Over 700 Years Blog

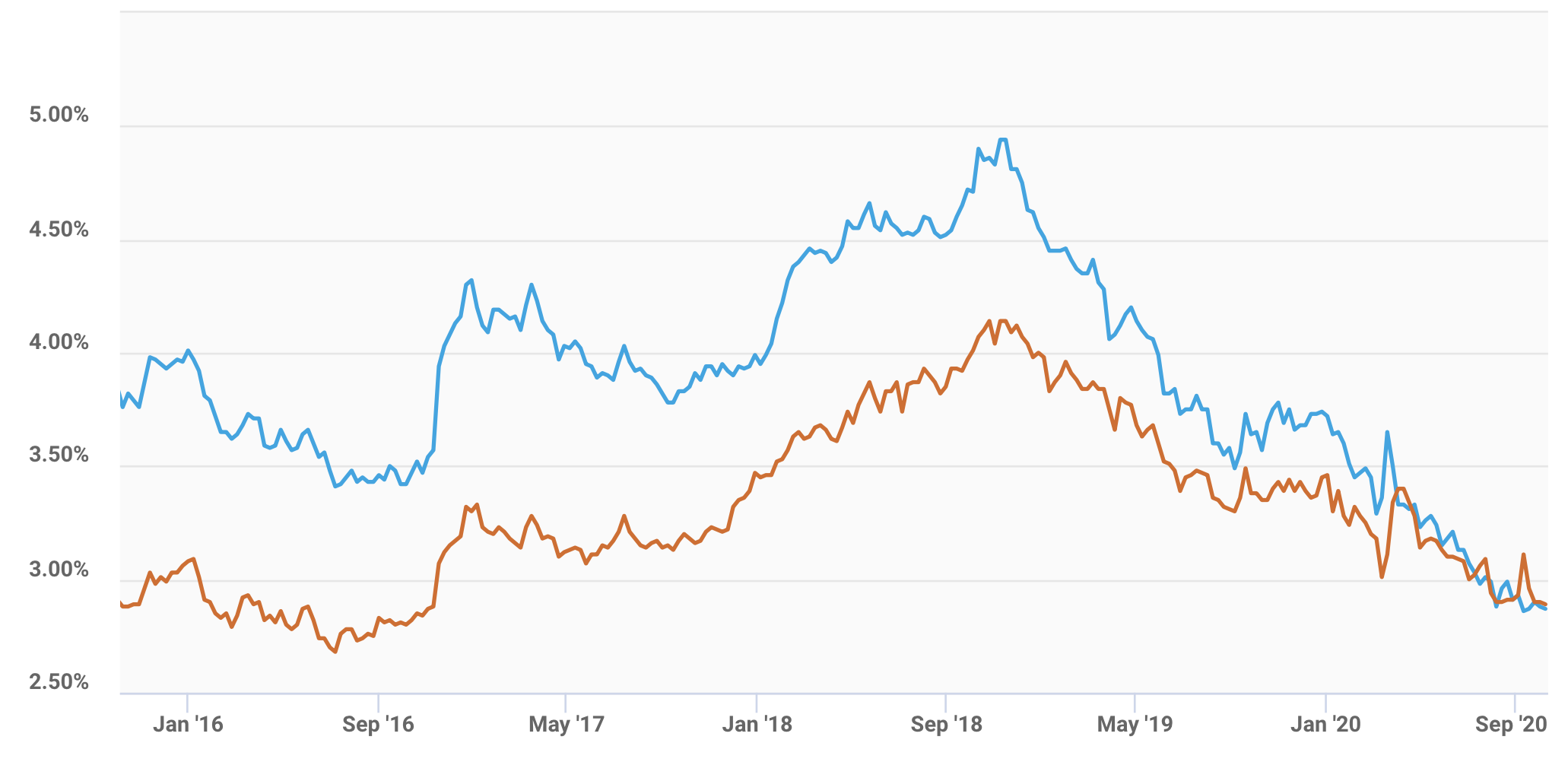

Note the declining Bond Yield fixed rate trend into 2023.

. Mortgage Rate Forecast in Canada. Monthly Average Commitment Rate And Points On 30-Year Fixed-Rate Mortgages Since 1971. What is the difference between interest rate and APR on a mortgage.

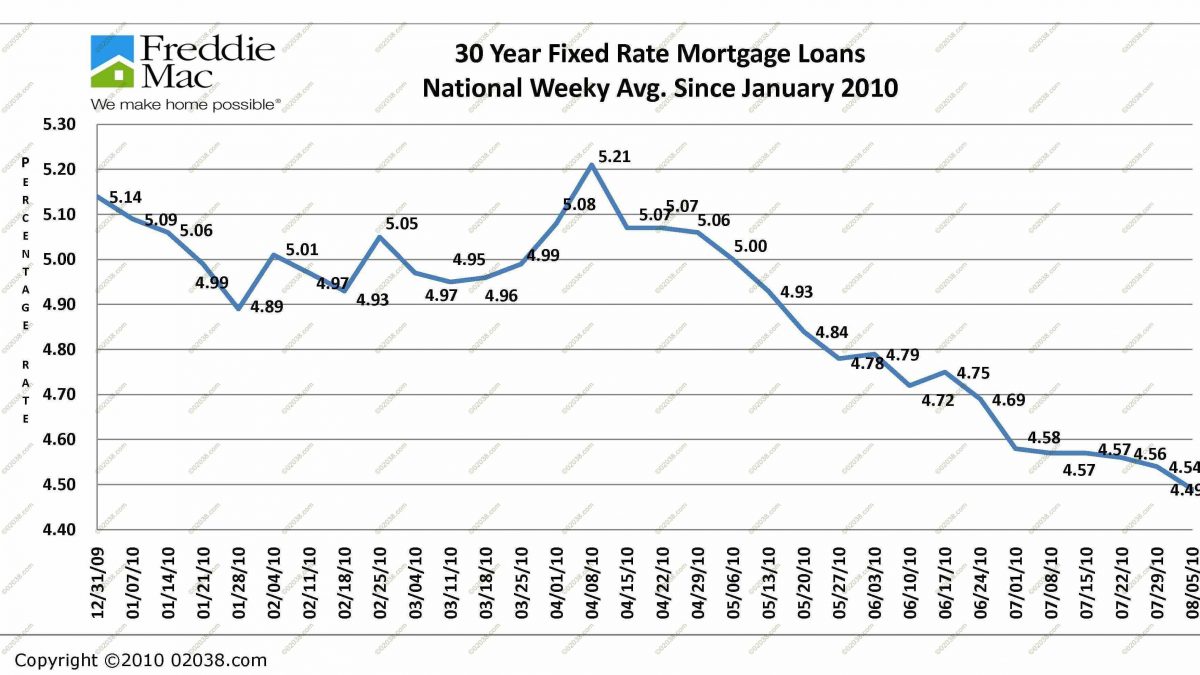

In a July 20 forecast. Interest rates and annual percentage rates APR are two different ways of expressing the fees a borrower incurs when taking out a mortgage. The rate on the 30-year fixed mortgage edged down to 513 from 522 the week prior according to Freddie MacWhile the rate remains lower than the 581 registered in June its still nearly 2 percentage points higher than the start of the year.

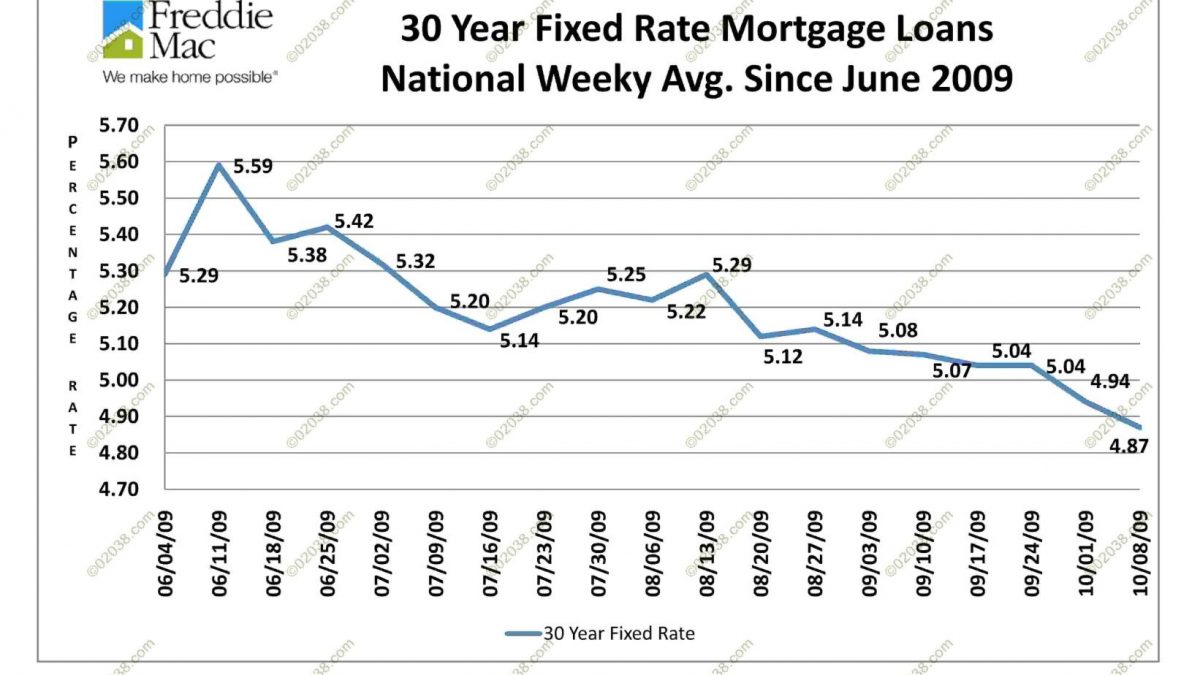

However they gradually made their way back below the 6 mark by 2003 and remained in the high 5 to low 6 range for the rest of the decade before briefly dropping to a decade low of 481 in 2009. Mortgage rates have dropped about half a percentage point in recent weeks heading closer to 55 percent than the 6 percent rates we saw in June said Mike Fratantoni chief economist at. Want expert mortgage advice and the best rates.

Rates depend on several. The average 15-year fixed and 30-year fixed mortgage rates both were higher. October 2021s inflation started the trend higher so year-over-year comparisons will give us some relief.

Thanks to Freddie Mac theres solid data available for 30-year fixed-rate mortgage rates beginning in 1971. When choosing a lender compare official Loan Estimates from at least three different lenders and specifically pay attention to which have the lowest rate and lowest APR. How a 20-year.

When mortgage rates are lower. The average interest rate for a 30-year mortgage has climbed above 6 a level unseen since 2008 reaching 612 this week. Historical mortgage rates from the early 1970s to 2019 have been on a decidedly downward trend.

Today a few important mortgage rates moved up. High ratio mortgage with 20 annual pre-payment. That could change after the Federal Reserve raises its interest rate as.

The average rate of the most common type of variable-rate. Compare the latest rates loans payments and fees for ARM and fixed-rate mortgages. Its no difference when it comes to mortgage rates.

Mortgage rates jumped during the first half of 2022. The charts tell the story painting a remarkable picture of the history of US. 1 day agoMortgage rates surpass 6 percent for the first time since 2008.

Inflation continues to affect 30-year fixed mortgage rates which rose to an average 612 percent in Bankrates weekly survey of big lenders. Along with mortgage interest rates each lender has fees and closing costs that factor into the overall cost of the home loan. Although the increase in rates will continue to dampen demand and put downward pressure on home prices inventory remains inadequate.

View todays mortgage rates for fixed and adjustable-rate loans. For more information check out. Heres where economists predict rates will go for the rest of the year.

1 day agoA handful of important mortgage rates moved up Thursday. They briefly dipped down into the mid- to high-8 range before climbing to 1120 in 1979. Interest rate relates to the cost of borrowing stated as a percentage on the principal amount of a mortgage.

Apple Watch Series 8 Review iPhone 14 Pro Pro Max Review Apple Watch SE 2022. Rates in 1971 were in the mid-7 range and they moved up steadily until they were at 919 in 1974. As interest rates surge its getting more expensive to buy a house.

Mortgage rates continued to rise alongside hotter-than-expected inflation numbers this week exceeding six percent for the first time since late 2008. Weekly Rate Recap Mortgage Rates Today. Mortgage rates pulled back this week but economic uncertainty continues to keep price-struck buyers at bay.

The downward trend in mortgage rates stalled out and reversed course with rates jumping back above 8 in 2000. The number of mortgage applications decreased 12 as reported by Mortgage Bankers. The average mortgage interest rates increased for all three loan types week over week 30-year fixed rates went up 589 to 602 as did 15-year fixed rates 516 to 521 and 51 ARM rates 464 to 493.

As a result mortgage rates have been. Get a custom rate based on your purchase price down payment amount and ZIP code and explore your home loan options at Bank of America.

How You Can Beat Rising Mortgage Rates In 2022 Warren Reynolds

30 Years Of Summer Followed By 30 Years Of Winter Firsttuesday Journal

Financing St Louis Real Estate News

20 Advantages And Disadvantages Of Erp System In 2022 Erp System Financial Management Relationship Management

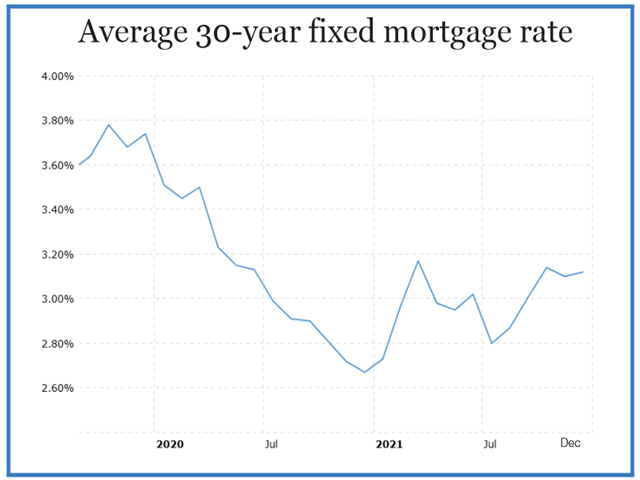

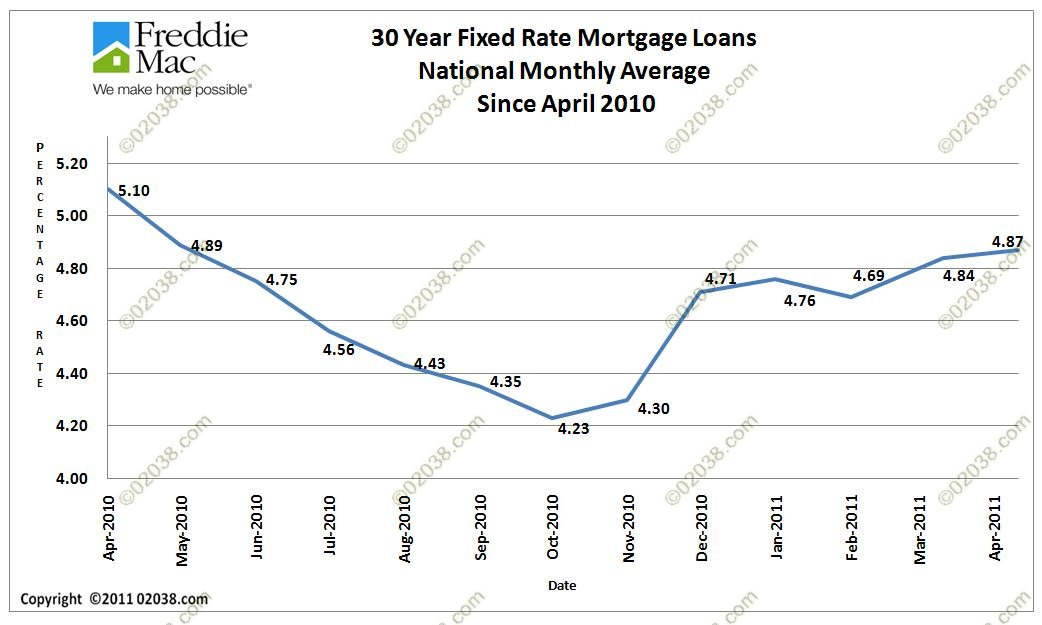

Mortgage Rates Near Record Lows 02038 Real Estate

The Essential Sections Of A Business Plan Business Planning How To Plan Business Resources

7 Reasons To Work With A Realtor Online Learning Real Estate Investing Home Ownership

Common Questions About Reverse Mortgages Part 4 Reverse Mortgage Mortgage How To Get Money

How You Can Beat Rising Mortgage Rates In 2022 Warren Reynolds

Mortgage Rates At Historic Lows Again 02038 Real Estate

Va Loan Process A Graphic Road Map To Your Home Loan Benefits Va Loan Process Va Loan Home Loans

California Mortgage Rates Trends 30 Year Fixed Better Than Arm Loan

Mortgage Rate Predictions For 2011 02038 Real Estate

Qiz J1p7cu1cm

Opec Opec Share Of World Crude Oil Reserves Intergovernmental Organization Crude Oil Crude

Mortgage Interest Rates Remain Low 02038 Real Estate

California Mortgage Rate For Forecast 2021 A Three Percent Kind Of Year